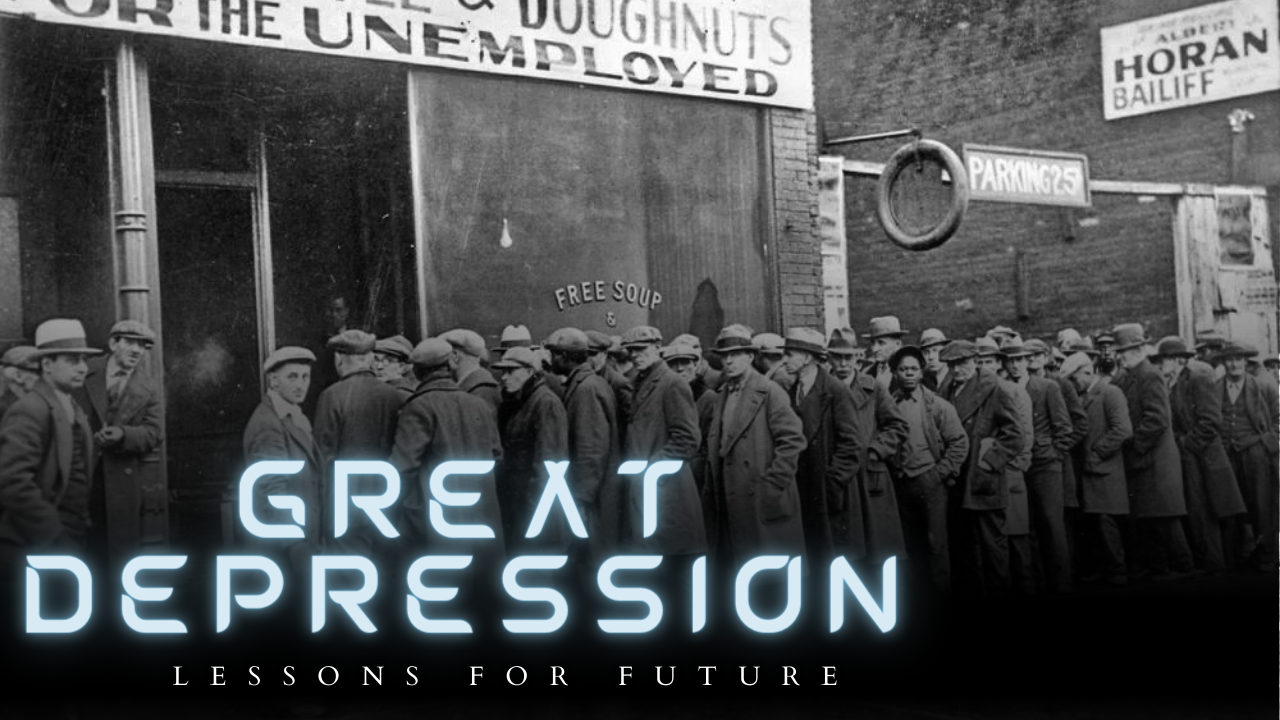

Great depression and lessons for the future

The Great Depression of the 1930s was a significant event in the history of the world economy. This period was marked by widespread unemployment, reduced economic activity, and deflationary pressures. The lessons learned from this period are crucial in guiding policymakers and individuals in managing economic downturns. This article will discuss the Great Depression and the lessons for the future from an economic perspective.

The Great Depression was a severe economic crisis that began in the United States in 1929 and quickly spread worldwide. The stock market crash of October 1929 is often considered the beginning of the depression. The crisis led to a significant reduction in output and employment and a decline in prices. Unemployment rates in the United States reached 25% in 1933, while GDP fell by over 30% between 1929 and 1933.

One of the main lessons from the Great Depression is the importance of fiscal and monetary policy in managing economic downturns. In response to the crisis, governments worldwide implemented expansionary fiscal policies, such as increasing government spending and reducing taxes, to stimulate economic activity. These policies helped to increase demand and mitigate the effects of the downturn. Monetary policy was also used to stimulate the economy. Central banks lowered interest rates to encourage borrowing and spending.

Another lesson from the Great Depression is the importance of international cooperation in managing economic crises. The depression spread quickly worldwide, and countries that relied heavily on international trade suffered the most. This realization led to the creation of institutions such as the International Monetary Fund and the World Bank, which promote international economic cooperation and provide financial assistance to countries in crisis.

The Great Depression also highlighted the importance of financial regulation and the need to prevent financial crises. The stock market crash of 1929 was largely attributed to the excessive speculation and risky behaviour of investors. In response, governments implemented regulations to prevent such behaviour and protect consumers. For example, the Glass-Steagall Act of 1933 separated commercial and investment banking, preventing banks from engaging in risky activities with depositors’ funds.

Finally, the Great Depression emphasized the importance of social safety nets and policies to protect the most vulnerable members of society during economic downturns. The New Deal, a series of economic and social policies implemented by President Franklin D. Roosevelt, supported the unemployed, elderly, and disabled. Social Security, unemployment insurance, and minimum wage laws were established to ensure all citizens’ basic living standards.

In conclusion, the Great Depression of the 1930s was a significant event in the history of the world economy. The lessons learned from this period are crucial in guiding policymakers and individuals in managing economic downturns. Fiscal and monetary policy, international cooperation, financial regulation, and social safety nets are all essential tools in mitigating the effects of economic crises. By applying these lessons, we can help to ensure that future economic downturns are managed effectively and that the most vulnerable members of society are protected.